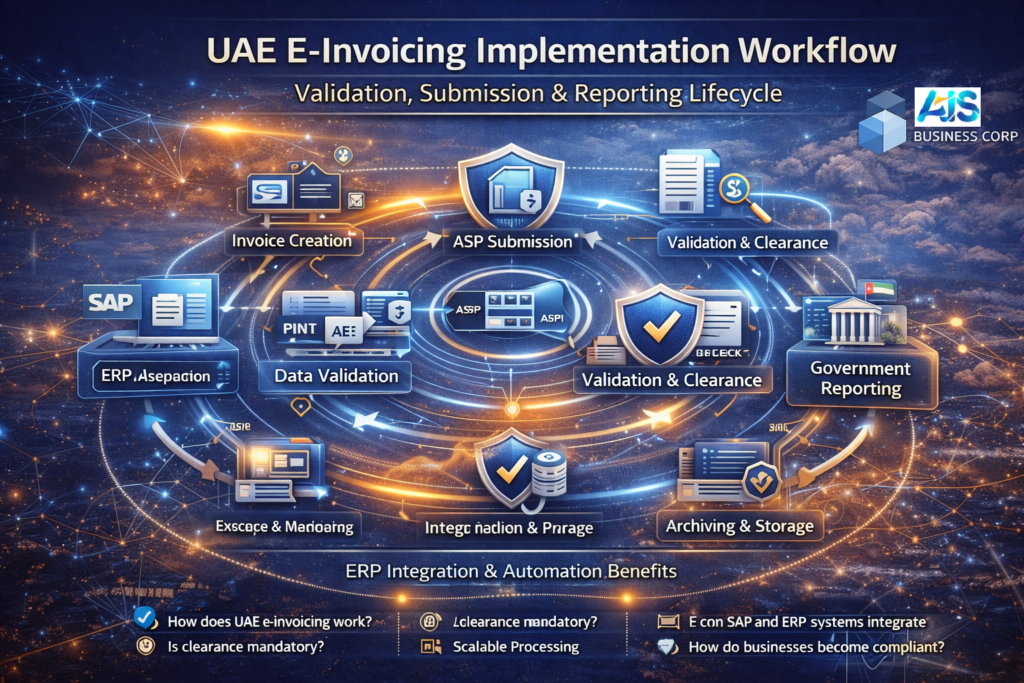

The UAE e-invoicing program introduces a structured, API-driven workflow designed to ensure real-time tax compliance, secure invoice exchange, and standardized digital reporting. For businesses using ERP systems such as SAP, Oracle, or localized accounting platforms, understanding the end-to-end e-invoicing workflow is critical for smooth implementation and ongoing compliance.

This blog explains the UAE e-invoicing implementation workflow, covering validation, submission, clearance, reporting, and archiving; mapped clearly to ERP and Accredited Service Provider (ASP) integration models.

Understanding the UAE E-Invoicing Workflow

The UAE follows a clearance-based digital invoicing model aligned with the PINT AE framework, where invoices are validated, exchanged, and reported through Accredited Service Providers before reaching trading partners and tax authorities.

This workflow ensures:

- Structured invoice data

- Real-time compliance checks

- Secure document exchange

- End-to-end auditability

Step 1: Invoice Creation in ERP System

The process begins when an invoice is generated in the ERP system.

This could be SAP Business One, SAP S/4HANA, or any ERP configured for UAE localization.

Key elements included:

- Supplier and buyer details

- VAT registration numbers

- Line-item tax calculations

- Invoice references and timestamps

- Multi-language data (English/Arabic where applicable)

Step 2: Pre-Validation & Data Standardization

Before submission, the invoice data undergoes pre-validation to ensure it complies with:

- PINT AE data structure

- Mandatory field requirements

- Tax calculation accuracy

- Format and schema validation

This step reduces rejection risks and improves clearance success rates.

Step 3: API-Driven Invoice Submission to ASP

Once validated, invoices are transmitted to the Accredited Service Provider (ASP) using secure APIs.

This submission includes:

- Structured invoice payload

- Digital signatures (where applicable)

- ERP system identifiers

- Submission timestamps

The API-driven approach allows seamless, automated integration without manual intervention.

Step 4: E-Invoice Validation & Clearance Process

The ASP performs:

- Compliance validation

- Format and schema checks

- Business rule verification

- Duplicate and fraud checks

Upon successful validation, the invoice is cleared and assigned a unique reference ID.

Cleared invoices are then ready for exchange and reporting.

Step 5: Invoice Exchange with Trading Partners

After clearance:

- The invoice is delivered electronically to the buyer

- The buyer receives a compliant, validated digital invoice

- Both parties retain audit-ready records

This ensures faster processing, fewer disputes, and consistent data integrity.

Step 6: Administrative Reporting to Authorities

The ASP manages administrative reporting, transmitting required invoice data to relevant UAE authorities in accordance with regulatory timelines.

This step supports:

- VAT audit readiness

- Regulatory transparency

- Real-time tax oversight

Step 7: E-Invoicing Archiving & Storage

Cleared invoices must be securely archived in compliance with UAE retention policies.

Archiving includes:

- Tamper-proof storage

- Searchable invoice retrieval

- Long-term digital preservation

- Audit and compliance access

Step 8: Analytics, Monitoring & Compliance Dashboards

Modern e-invoicing implementations provide dashboards that offer:

- Invoice status tracking

- Clearance success rates

- Error analysis

- Compliance health monitoring

These insights help businesses proactively manage compliance risks.

ERP Integration & Automation Benefits

When properly implemented, the UAE e-invoicing workflow enables:

- End-to-end automation

- Reduced manual errors

- Faster invoice processing

- Continuous compliance monitoring

- Scalable operations across regions

How AIS Business Corp Supports UAE E-Invoicing Implementation?

AIS Business Corp helps organizations:

- Design ERP-aligned e-invoicing workflows

- Integrate with UAE Accredited Service Providers

- Configure SAP and ERP compliance automation

- Manage validation, reporting, and archiving

Provide AMC, monitoring, and 24/7 compliance support

Frequently Asked Questions (FAQs)

What is the UAE e-invoicing implementation workflow?

It is a structured process involving invoice creation, validation, submission to an ASP, clearance, exchange, reporting, and archiving.

Is invoice clearance mandatory in UAE e-invoicing?

Yes. Invoices must be validated and cleared through an Accredited Service Provider before exchange.

What role does the ASP play in the workflow?

The ASP validates, clears, exchanges, reports, and archives invoices in compliance with UAE regulations.

Can SAP systems support UAE e-invoicing workflows?

Yes. SAP Business One and SAP S/4HANA can support UAE e-invoicing through API or middleware integration.

What is PINT AE in the e-invoicing process?

PINT AE defines the standardized invoice data model used in the UAE e-invoicing framework.

How are invoices submitted to the ASP?

Invoices are submitted using secure, API-driven integrations from ERP systems.

Is manual invoice submission allowed?

Manual submission is not recommended. Automation ensures compliance, accuracy, and scalability.

How long should e-invoices be archived in UAE?

Invoices must be archived according to UAE VAT and digital record retention requirements.

Does the workflow support multi-language invoices?

Yes. ERP systems can support English and Arabic invoice data as required.

How can businesses monitor e-invoicing compliance?

Through dashboards, validation logs, reporting status, and ongoing application monitoring services.

Planning to implement UAE e-invoicing or optimize your current workflow?

Talk to AIS Business Corp for ERP-aligned e-invoicing implementation, ASP integration, and end-to-end compliance support across the UAE.