Why UAE E-Invoicing is a Structural Reform, Not Just a Tax Change?

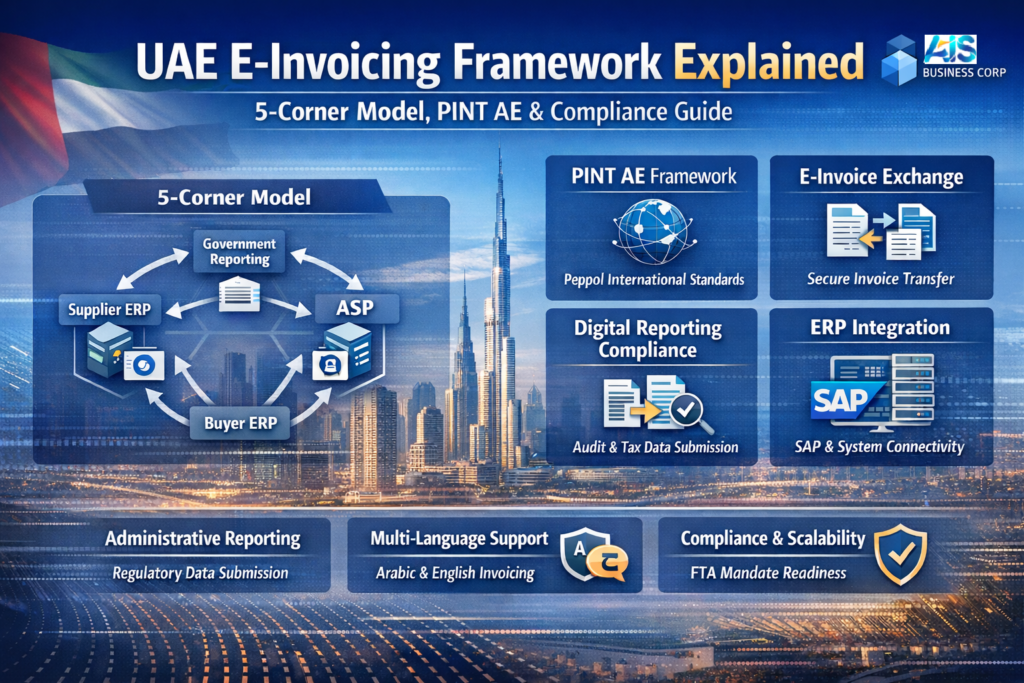

The UAE e-invoicing initiative is not a simple digitization of invoices. It is a nationwide digital compliance framework designed to enable real-time invoice exchange, standardized reporting, and automated tax administration. Led by the UAE government and implemented through the 5-corner e-invoicing model, the framework aligns with global standards such as PINT AE (Peppol International) while addressing local regulatory, linguistic, and ERP integration requirements.

For businesses operating in Dubai, Abu Dhabi, Sharjah, Ajman, and across the UAE, understanding the regulatory framework, exchange model, and compliance architecture is essential to avoid future disruptions and penalties.

What is UAE E-Invoicing?

UAE e-invoicing is a structured digital invoicing system where invoices are:

- Created in a standardized electronic format

- Validated through accredited service providers (ASP)

- Exchanged securely between buyers and sellers

- Reported to government systems for tax and compliance monitoring

Unlike PDF or email invoices, UAE e-invoices are machine-readable, validated, and traceable across their entire lifecycle.

Overview of the UAE E-Invoicing Regulatory Framework

The UAE e-invoicing regulatory framework is governed by:

- Federal tax digitization objectives

- Digital reporting and audit readiness requirements

- Standardized invoice exchange rules

- Secure document storage and archiving mandates

The framework ensures:

- Uniform invoice data structures

- Controlled exchange through accredited entities

- Administrative reporting capabilities for authorities

- Scalability across industries and ERP systems

This framework forms the foundation for the UAE e-invoice exchange model.

Understanding the UAE 5-Corner E-Invoicing Model

What Is the 5-Corner Model?

The 5-corner model is the backbone of UAE e-invoicing architecture. It enables interoperable invoice exchange while keeping the government out of direct transactional flows.

The Five Corners Explained

- Supplier ERP System

Generates the e-invoice in a structured format. - Supplier Accredited Service Provider (ASP)

Validates, formats, and securely transmits the invoice. - Buyer Accredited Service Provider (ASP)

Receives and validates the invoice for the buyer. - Buyer ERP System

Processes and records the compliant invoice. - Government / Regulatory Systems

Receives administrative reporting data, not transaction-by-transaction clearance.

Why the 5-Corner Model Matters?

- Ensures scalability across millions of invoices

- Prevents system bottlenecks

- Enables ERP-agnostic adoption

- Aligns UAE with global best practices

This model is fundamentally different from real-time clearance systems used in some other countries.

What Is PINT AE and Its Role in UAE E-Invoicing?

Understanding the PINT AE Framework

PINT AE (Peppol International) defines a standardized data and exchange framework tailored for the UAE. It ensures:

- Common invoice data structures

- Interoperability between service providers

- Alignment with international digital trade standards

Why PINT AE is Critical?

- Prevents vendor lock-in

- Enables cross-platform ERP compliance

- Supports multi-language invoice content

- Simplifies future regional expansion

PINT AE acts as the technical and semantic backbone of UAE e-invoicing.

UAE E-Invoice Exchange Framework Explained

The UAE e-invoice exchange framework enables:

- Secure invoice transmission

- Identity validation through accredited providers

- End-to-end traceability

- Administrative reporting to authorities

Invoices are exchanged between businesses, while compliance data is shared with government systems.

This ensures:

- Business continuity

- Data privacy

- Audit readiness

UAE E-Invoicing Administrative Reporting

Unlike clearance models, the UAE approach focuses on administrative reporting, which includes:

- Invoice metadata submission

- Periodic reporting

- Compliance validation records

- Audit trail availability

This model reduces operational friction while maintaining regulatory oversight.

Digital Reporting Compliance in the UAE

Digital reporting compliance requires businesses to:

- Maintain structured invoice data

- Ensure ERP integration accuracy

- Store invoices securely for mandated periods

- Provide analytics and reporting when required

Failure to comply may lead to:

- Audit challenges

- Penalties

- Operational delays

ERP Readiness for UAE E-Invoicing?

ERP systems must support:

- Structured invoice generation

- API-driven integration with ASPs

- Localization for UAE requirements

- Multi-language support (Arabic and English)

- Secure archiving and retrieval

SAP and enterprise ERPs require specialized integration architecture to remain compliant.

Why Businesses Must Prepare Early?

Early preparation enables:

- Smooth onboarding with accredited providers

- Clean ERP data mapping

- Reduced compliance risks

- Better scalability as mandates evolve

Waiting until enforcement phases begin often results in rushed, costly implementations.

How AIS Business Corp Supports UAE E-Invoicing Compliance?

AIS Business Corp (aiscorp.ai) helps organizations:

- Understand UAE e-invoicing regulations

- Design ERP-to-ASP integration architecture

- Align SAP and ERP systems with PINT AE

- Ensure long-term compliance and scalability

With expertise across ERP, compliance automation, and managed services, AIS enables businesses to adopt UAE e-invoicing confidently.

Frequently Asked Questions (FAQs)

What is the 5-corner model in UAE e-invoicing?

It is an exchange framework where invoices flow between supplier and buyer through accredited service providers, with government systems receiving administrative reporting data.

Is UAE e-invoicing a clearance model?

No. UAE follows an exchange and reporting model, not real-time invoice clearance.

What is PINT AE?

PINT AE is the UAE-aligned Peppol International framework defining invoice standards and interoperability rules.

Are PDFs considered valid e-invoices in the UAE?

No. PDFs are not structured e-invoices and do not meet compliance requirements.

Do all ERPs support UAE e-invoicing?

No. Most ERPs require customization, add-ons, or middleware integration.

Will e-invoicing be mandatory across all industries?

The rollout is expected to expand in phases across sectors.

Is Arabic mandatory for UAE e-invoices?

Localization and multi-language support are part of compliance considerations.

How long must e-invoices be archived?

Invoices must be securely stored according to UAE regulatory retention rules.

UAE e-invoicing represents a long-term digital compliance transformation. Understanding the 5-corner model, PINT AE framework, and regulatory architecture is essential for businesses aiming to remain compliant, scalable, and audit-ready.

Prepare Your ERP for UAE E-Invoicing with Confidence

UAE e-invoicing is a regulatory transformation that requires the right framework understanding, ERP readiness, and integration strategy. AIS Business Corp helps businesses assess their current ERP landscape, align with the UAE 5-corner model and PINT AE framework, and prepare for compliant e-invoicing implementation.

👉 Talk to our UAE e-invoicing and SAP compliance experts to understand your readiness and next steps.