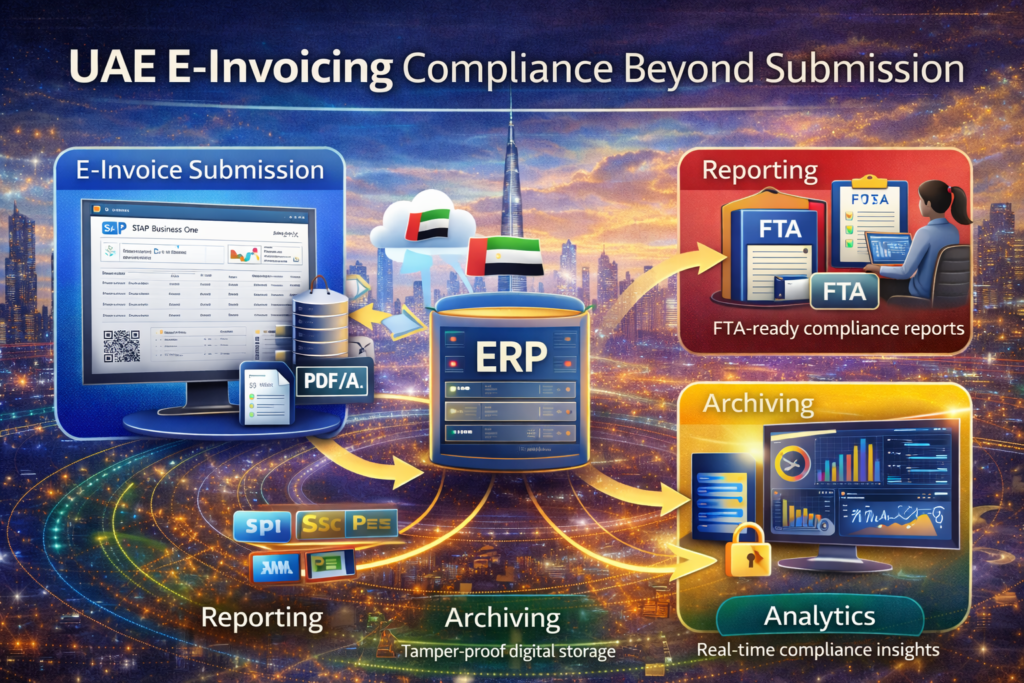

As the UAE moves steadily toward a fully digitized tax ecosystem, e-invoicing compliance no longer ends with successful invoice submission. Businesses operating in Dubai, Abu Dhabi, Sharjah, Ajman, and across the UAE must now focus on what comes next: accurate reporting, secure archiving, and actionable analytics.

The Federal Tax Authority (FTA) expects organizations to maintain transparent, traceable, and audit-ready invoice data long after an invoice is issued. This is where ERP-driven e-invoicing reporting, archiving, and analytics become critical for sustainable compliance and smarter decision-making.

Why Compliance Goes Beyond E-Invoice Submission?

Submitting an e-invoice to an accredited service provider (ASP) or clearing platform is only one step in the UAE e-invoicing lifecycle. Post-submission requirements include:

- Regulatory-ready reporting

- Long-term invoice archiving

- Real-time visibility into tax and financial data

- Audit readiness for FTA reviews

Organizations that ignore these elements risk penalties, audit complications, and operational inefficiencies.

UAE E-Invoicing Reporting: Ensuring Transparency & Accuracy

E-invoicing reporting enables businesses to track, reconcile, and validate invoice data across systems and tax periods.

Key Reporting Capabilities Required in the UAE

- VAT-wise and transaction-wise invoice reporting

- Sales and purchase invoice summaries

- FTA-aligned tax reporting formats

- Cross-border transaction visibility

- Exception and error reporting

For enterprises in Dubai and Abu Dhabi, where transaction volumes are high, ERP-based reporting ensures real-time compliance monitoring and faster financial closures.

E-Invoice Archiving: Meeting UAE FTA Record-Keeping Rules

The UAE FTA mandates that businesses retain tax invoices and related records for a minimum of five years (longer in certain cases).

What Compliant E-Invoice Archiving Looks Like?

- Secure digital storage (cloud or on-premise)

- Tamper-proof and audit-ready records

- Easy retrieval for audits and internal reviews

- Support for structured formats (XML, PDF/A)

- Metadata preservation (QR codes, hashes, timestamps)

For businesses in Sharjah, Ajman, and other emirates, centralized ERP archiving simplifies compliance while reducing dependence on manual document storage.

Analytics: Turning E-Invoicing Data into Business Intelligence

E-invoicing generates a rich stream of structured financial and tax data. When integrated with ERP analytics tools, this data becomes a powerful asset.

Benefits of E-Invoicing Analytics

- VAT trend analysis and forecasting

- Cash-flow and receivables insights

- Compliance risk detection

- Regional performance tracking (Dubai vs Abu Dhabi operations)

- Faster, data-driven decision-making

With SAP-based analytics, organizations gain real-time dashboards that align finance, compliance, and leadership teams.

Role of ERP Systems in End-to-End E-Invoicing Compliance

Modern ERP platforms such as SAP S/4HANA and SAP Business One play a central role in managing the full e-invoicing lifecycle:

- Automated invoice generation and submission

- Built-in VAT validation and controls

- Centralized reporting and archiving

- Advanced analytics and compliance dashboards

- Seamless integration with UAE-approved ASPs

For multi-branch businesses across the UAE, ERP-led compliance ensures consistency, scalability, and regulatory confidence.

Common Challenges UAE Businesses Face

Despite digital progress, many organizations still struggle with:

- Disconnected reporting systems

- Manual invoice archiving

- Limited compliance visibility

- Difficulty retrieving records during audits

- Underutilization of invoice data

Addressing these challenges early helps businesses stay ahead of evolving UAE e-invoicing mandates.

How AIS Business Corp Helps UAE Businesses Stay Compliant?

AIS Business Corp, a trusted SAP partner, helps organizations across Dubai, Abu Dhabi, Sharjah, and the wider UAE implement end-to-end e-invoicing solutions that go beyond submission.

Our Expertise Covers:

- SAP ERP e-invoicing integration

- FTA-compliant reporting frameworks

- Secure digital invoice archiving

- Real-time analytics and dashboards

- Ongoing compliance and AMS support

We ensure your e-invoicing ecosystem is audit-ready, insight-driven, and future-proof.

Frequently Asked Questions (FAQs)

What is UAE e-invoicing reporting?

UAE e-invoicing reporting refers to generating structured reports from ERP systems that summarize invoice data, VAT details, and transaction history in line with FTA compliance requirements.

How long must e-invoices be archived in the UAE?

The UAE Federal Tax Authority requires businesses to retain tax invoices and related records for at least five years, with longer retention periods for certain assets or legal cases.

Is digital archiving mandatory for UAE e-invoices?

Yes. E-invoices must be stored electronically in a secure, tamper-proof format that allows easy retrieval during FTA audits or inspections.

What formats are acceptable for e-invoice archiving?

Acceptable formats include XML, PDF/A, and other structured digital formats that preserve invoice data, QR codes, timestamps, and tax metadata.

How does ERP help with e-invoicing compliance beyond submission?

ERP systems automate reporting, enable centralized archiving, provide audit trails, and deliver analytics dashboards that help businesses monitor compliance continuously.

Why is analytics important in UAE e-invoicing?

Analytics helps businesses identify VAT trends, detect compliance risks, track cash flow, and gain real-time financial insights across locations like Dubai and Abu Dhabi.

Can UAE businesses retrieve archived invoices during an FTA audit?

Yes. Businesses must be able to retrieve archived invoices quickly and accurately upon request by the UAE Federal Tax Authority.

Are multi-branch businesses required to maintain centralized e-invoice records?

While not mandatory, centralized archiving and reporting is highly recommended for businesses operating across multiple emirates to ensure consistency and audit readiness.

How does SAP support UAE e-invoicing reporting and archiving?

SAP solutions such as SAP S/4HANA and SAP Business One provide built-in compliance controls, automated reporting, secure archiving, and real-time analytics.

How can AIS Business Corp support UAE e-invoicing compliance?

AIS Business Corp delivers end-to-end SAP e-invoicing solutions, including FTA-aligned reporting, compliant archiving, analytics dashboards, and ongoing compliance support.

UAE e-invoicing compliance doesn’t stop at invoice submission. Reporting, archiving, and analytics are essential pillars that protect your business, support audits, and unlock data-driven growth.

Organizations that invest in ERP-enabled post-submission compliance today will be better positioned for future FTA enhancements and real-time tax reporting models.

Looking to strengthen your UAE e-invoicing compliance beyond submission?

Contact AIS Business Corp today to build a robust, compliant, and analytics-driven e-invoicing framework tailored for your business.