Why Accredited Service Providers Matter in UAE E-Invoicing?

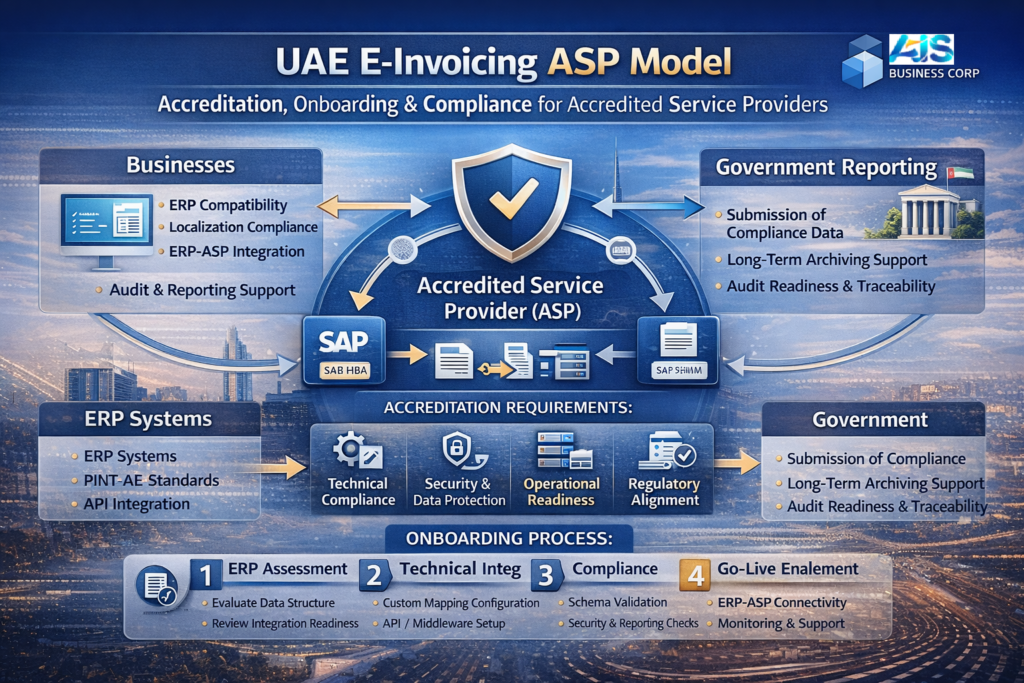

The UAE e-invoicing framework relies on a decentralized exchange model, where Accredited Service Providers (ASPs) play a central role in enabling secure, compliant, and interoperable invoice exchange. Unlike direct government clearance systems, the UAE approach depends on ASPs to validate, transmit, and report e-invoice data while ensuring businesses remain compliant with regulatory and technical standards.

Understanding the ASP model, accreditation requirements, and onboarding process is essential for businesses preparing for UAE e-invoicing compliance.

What is an Accredited Service Provider (ASP) in UAE E-Invoicing?

An Accredited Service Provider (ASP) is an authorized intermediary responsible for:

- Validating structured e-invoices

- Ensuring compliance with UAE e-invoicing standards

- Securely exchanging invoices between trading partners

- Supporting administrative reporting obligations

ASPs act as the trusted compliance and technology layer between ERP systems and the broader e-invoicing ecosystem.

Role of ASPs in the UAE 5-Corner Model

Within the UAE 5-corner e-invoicing model, ASPs operate on both the supplier and buyer sides.

ASP Responsibilities Include:

- Invoice format validation

- Schema and data accuracy checks

- Secure invoice transmission

- Interoperability with other ASPs

- Compliance reporting support

This model ensures flexibility, scalability, and ERP independence across industries.

UAE ASP Accreditation Requirements Explained

To operate legally within the UAE e-invoicing ecosystem, ASPs must meet strict accreditation requirements, which typically cover:

1. Technical Compliance

- Support for structured e-invoice formats

- Alignment with PINT AE standards

- Secure API-based integration capabilities

- High availability and performance benchmarks

2. Security & Data Protection

- End-to-end encryption

- Secure data storage and transmission

- Access control and identity management

- Audit-ready logging and traceability

3. Operational Readiness

- Scalable infrastructure

- Incident management procedures

- Disaster recovery and business continuity plans

- Service level commitments

4. Regulatory Alignment

- Compliance with UAE digital reporting obligations

- Support for administrative reporting requirements

- Long-term data retention capabilities

Accreditation ensures trust and interoperability across the entire ecosystem.

ASP Onboarding Process in UAE E-Invoicing

The ASP onboarding process defines how businesses connect their ERP systems to accredited providers.

Typical Onboarding Stages

- ERP Assessment

- Evaluate invoice data structure

- Identify localization gaps

- Review integration readiness

- Evaluate invoice data structure

- Technical Integration

- API or middleware configuration

- Mapping ERP fields to e-invoice standards

- Testing connectivity and data exchange

- API or middleware configuration

- Compliance Validation

- Schema validation

- Security checks

- Reporting readiness verification

- Schema validation

- Go-Live Enablement

- Production deployment

- Monitoring and error handling setup

- Support escalation procedures

- Production deployment

Proper onboarding minimizes disruptions and ensures ongoing compliance.

UAE E-Invoicing Onboarding Considerations for Businesses

Businesses should consider:

- ERP compatibility and customization needs

- Multi-entity and multi-branch scenarios

- Invoice volumes and performance requirements

- Integration timelines

- Long-term compliance support

Choosing the right ASP is both a technical and strategic decision.

Administrative Reporting Support by ASPs

ASPs assist businesses in meeting UAE e-invoicing administrative reporting obligations by:

- Capturing invoice metadata

- Maintaining audit logs

- Supporting regulatory reporting workflows

- Ensuring traceability across invoice lifecycles

This reduces compliance risk and improves audit readiness.

ERP Integration and ASP Collaboration

ASPs must seamlessly integrate with ERP systems such as:

- SAP Business One

- SAP S/4HANA

- Other enterprise and mid-market ERPs

Integration is typically achieved through API-driven or middleware-based architectures, enabling automation and scalability.

Common Challenges During ASP Onboarding

Some typical challenges include:

- ERP data inconsistencies

- Localization and language requirements

- Legacy system limitations

- Performance optimization for high invoice volumes

- Change management and user adoption

Early planning and expert support significantly reduce these risks.

Why Early ASP Engagement Is Important?

Engaging with an ASP early allows businesses to:

- Identify integration gaps

- Align ERP data structures

- Plan phased compliance

- Avoid last-minute implementation pressure

Early readiness leads to smoother adoption and lower total cost.

How AIS Business Corp Supports ASP Onboarding & Compliance?

AIS Business Corp supports organizations by:

- Assessing ERP readiness for ASP onboarding

- Designing compliant integration architecture

- Coordinating ERP-to-ASP connectivity

- Ensuring long-term compliance and support

Our expertise helps businesses adopt UAE e-invoicing with confidence and clarity.

Frequently Asked Questions (FAQs)

What is an Accredited Service Provider in UAE e-invoicing?

An ASP is an authorized entity that validates, exchanges, and supports compliant e-invoicing between businesses.

Is ASP usage mandatory in UAE e-invoicing?

Yes. E-invoice exchange is facilitated through accredited service providers.

How are ASPs accredited in the UAE?

Through regulatory and technical approval processes aligned with UAE e-invoicing standards.

Can businesses choose their own ASP?

Yes. Businesses may select from approved ASPs based on their ERP and operational needs.

Does an ASP replace ERP systems?

No. ASPs integrate with ERP systems; they do not replace them.

Is ASP onboarding a one-time activity?

Initial onboarding is one-time, but ongoing compliance and updates are required.

Can one ASP serve multiple ERP systems?

Yes. ASPs are designed to support multiple ERPs and trading partners.

Do ASPs handle invoice storage?

Many ASPs support archiving, but responsibility may vary based on agreements.

Is PINT AE compliance mandatory for ASPs?

Yes. ASPs must align with PINT AE and UAE technical standards.

What happens if an ASP fails compliance checks?

Non-compliant ASPs may face corrective actions or loss of accreditation.

Accredited Service Providers are the operational backbone of UAE e-invoicing. Understanding ASP accreditation requirements and onboarding workflows helps businesses make informed decisions, reduce risk, and achieve sustainable compliance.

Plan Your ASP Onboarding with Confidence

AIS Business Corp helps businesses prepare their ERP systems, connect with accredited service providers, and maintain long-term UAE e-invoicing compliance.

👉 Speak to our UAE e-invoicing experts to plan your ASP onboarding strategy.